A Comprehensive Overview of Mining Cabins Not Patented But Pay Taxes in Nevada Qui

Introduction

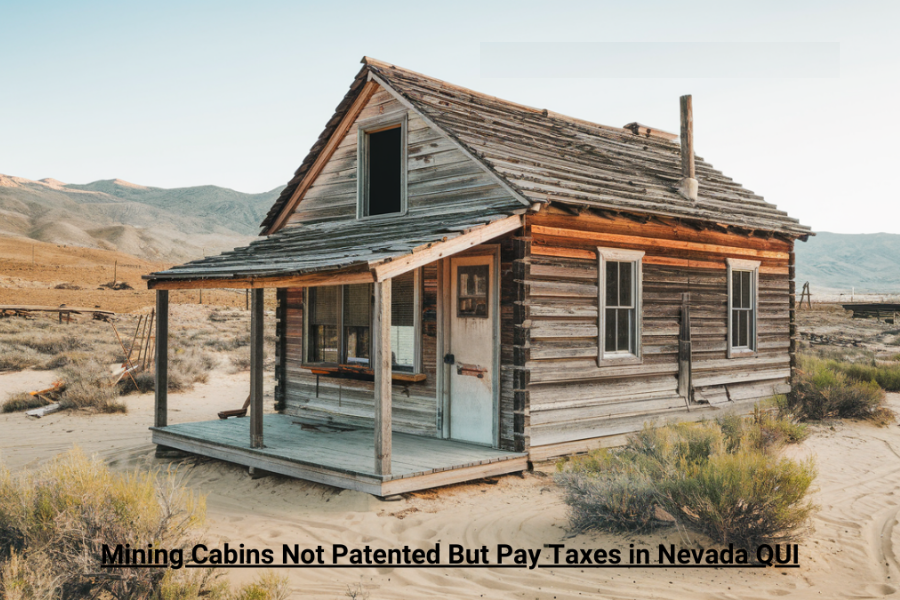

This article delves into the circumstances surrounding mining cabins not patented but pay taxes in nevada qui. It explores the implications for miners, property owners, and the broader state economy. For over a century, mining has played a crucial role in shaping Nevada’s economy and culture. The state is well-known for its abundant mineral resources and lively mining communities. However, the intricacies of mining regulations can be quite complex, especially regarding the ownership and taxation of these mining cabins.

Nevada’s Mining Environment

Nevada stands as the leading gold producer in the United States, boasting a rich mining heritage that traces back to the 19th century. Its expansive terrains are sprinkled with mining claims, many of which feature cabins constructed by miners for a variety of uses. These cabins function not only as shelters but also as workspaces and, in some cases, residences for those involved in mining operations. However, the legal status of these cabins can differ greatly, especially when distinguishing between patented and unpatented claims.

Mining Claims: Patented vs. Unpatented

To understand the nuances of mining cabins not patented but pay taxes in Nevada qui, The distinction between patented and unpatented mining claims must first be understood.

Patented Claims: A patented mining claim refers to a specific piece of land for which the miner has successfully secured a patent from the federal government, granting them complete ownership rights. This ownership allows the miner to take any action with the land, such as constructing cabins, selling the property, or utilizing it for other purposes. Patented claims are relatively uncommon and usually require an extensive process to demonstrate the land’s value and acquire the necessary permits.

Unpatented Claims: In contrast, unpatented mining claims grant miners the right to explore and extract minerals, but they do not confer ownership of the land itself. The federal government maintains ownership, while miners are permitted to use the land strictly for mining activities. Although miners can build cabins on these unpatented claims, they do not possess the same legal rights as those who hold patented claims.

This distinction is significant as it influences how cabins are regarded in terms of taxation and legal obligations.

The Effects of Non-Patented Mining Cabins on the Law

When exploring the issue of mining cabins not patented but pay taxes in nevada qui, it’s crucial to examine the legal framework that applies to these structures. Cabins constructed on unpatented claims are typically regulated by a distinct set of rules in comparison to those found on patented claims.

Tax Requirements

Although the land remains federally owned, Nevada state law mandates that certain taxes must be paid on improvements made to unpatented mining claims, including cabins. This creates a complex scenario where miners and cabin owners must navigate both state and federal regulations.

Property Taxes: In Nevada, any enhancements made to unpatented claims, such as cabins, may be subject to property taxes. Consequently, even though the land itself is not owned by the cabin owner, the structures erected on it can still incur tax liabilities. This situation can be particularly challenging for miners who are already dealing with financial instability due to the unpredictable nature of the mining industry.

Mining Taxes: Beyond property taxes, miners may also face specific mining taxes imposed based on the extraction and sale of minerals. This adds yet another layer of financial responsibility for those operating on unpatented claims.

Permit Fees: Additionally, miners may encounter fees associated with obtaining permits necessary for the construction and upkeep of cabins. These permits are crucial for ensuring that the structures comply with safety and environmental regulations, but they also contribute to the financial burden on miners.

Regulatory Supervision

The federal Bureau of Land Management (BLM) is responsible for overseeing unpatented mining claims in Nevada. Miners are required to comply with various regulations, which include maintaining their claims and ensuring that any structures, like cabins, adhere to safety and environmental standards. Non-compliance can lead to penalties, including the potential forfeiture of the mining claim.

The Effect of Mining Cabins on the Economy

Mining cabins, even those that are unpatented, can significantly influence the economy of local communities in Nevada. These structures often act as central points for mining activities, thereby supporting local economies in several ways.

Job Creation:Mining activities, regardless of their scale, can generate employment opportunities not only within the mining industry but also in various related fields. For instance, the existence of mining cabins can create demand for local services, such as:

Construction and Maintenance: Local contractors may have the chance to construct and upkeep these cabins, providing jobs for skilled workers in the area.

Supplies and Equipment: Shops that sell mining supplies, tools, and equipment can experience increased sales from miners who rely on cabins for their operations.

Tourism and Recreation:Interestingly, many mining cabins also attract tourists and outdoor enthusiasts keen on exploring Nevada’s mining history. Some cabins hold historical significance, drawing visitors who are interested in the state’s rich mining heritage. This influx of tourists can generate additional income for local businesses, including accommodations, dining, and recreational activities.

Problems Cabin Owners Face

Although owning a mining cabin has some benefits, mining cabins not patented but pay taxes in Nevada qui, It presents a unique set of difficulties, especially if the cabin is located on an unpatented property.

Financial Burden:As highlighted earlier, the costs associated with maintaining a cabin on an unpatented claim can be significant. The obligation to pay property taxes and other potential fees can create financial strain for miners, especially those operating on a smaller scale. This pressure can lead to tough decisions regarding the future of the cabin—whether to retain, sell, or abandon it entirely.

Legal Risks:The legal framework governing mining cabins is intricate, requiring miners to be proactive in ensuring compliance with regulations. Not adhering to the guidelines established by the Bureau of Land Management (BLM) can lead to penalties, including the potential loss of the claim. Furthermore, conflicts may arise between miners concerning claim boundaries or the legitimacy of specific structures, which can result in expensive legal disputes.

Conclusion:

In conclusion, the topic of mining cabins not patented but pay taxes in Nevada qui demonstrates the complex interplay between duty and opportunity in Nevada’s mining industry. These cabins can boost the local economy and offer crucial assistance for mining operations, but they also carry a lot of financial and regulatory obligations.

Understanding the implications of unpatented mining claims is essential for those involved in mining endeavors. As Nevada continues to prosper as a prominent mining hub, it is crucial for miners to effectively navigate the complexities of regulations, taxes, and the impacts on their communities. By doing so, they can ensure that their contributions to the state’s economy remain sustainable and advantageous for themselves and the communities in which they operate.

FAQs

1. What are mining cabins on unpatented claims?

Mining cabins on unpatented claims are structures built by miners on land where the federal government retains ownership. While miners have the right to explore and extract minerals from these claims, they do not own the land itself.

2. Do miners have to pay taxes on cabins located on unpatented claims in Nevada?

Yes, miners are required to pay property taxes on any improvements, such as cabins, made on unpatented mining claims, despite the land remaining federally owned.

3. What other financial obligations do miners face when owning cabins on unpatented claims?

In addition to property taxes, miners may incur specific mining taxes based on mineral production and sales. They may also face fees for permits required for building and maintaining their cabins, adding to their financial responsibilities.

4. What is the difference between patented and unpatented mining claims?

A patented mining claim grants complete ownership of the land to the miner, allowing them to use it as they wish, including building cabins. In contrast, an unpatented claim allows miners to use the land for mining but does not confer ownership of the land itself.

5. What regulatory body oversees unpatented mining claims in Nevada?

The Bureau of Land Management (BLM) is responsible for overseeing unpatented mining claims in Nevada. Miners must adhere to various regulations regarding safety, environmental standards, and claim maintenance.

6. How do mining cabins contribute to local economies in Nevada?

Mining cabins can stimulate local economies by creating jobs in construction, maintenance, and supply sales. Additionally, they attract tourists interested in Nevada’s mining history, benefiting local businesses such as hotels and restaurants.

7. What challenges do miners face with cabins on unpatented claims?

Miners may face financial burdens from taxes and fees, leading to difficult decisions about their cabins. Additionally, they must navigate a complex legal landscape, ensuring compliance with regulations to avoid penalties or loss of their claims.

8. How can miners ensure their contributions to Nevada’s economy are sustainable?

Miners can maintain sustainability by effectively managing their financial obligations, complying with regulatory requirements, and fostering positive relationships with local communities to ensure mutual benefits.

Uncover juicy celebrity rumors and entertainment updates on tamasha.